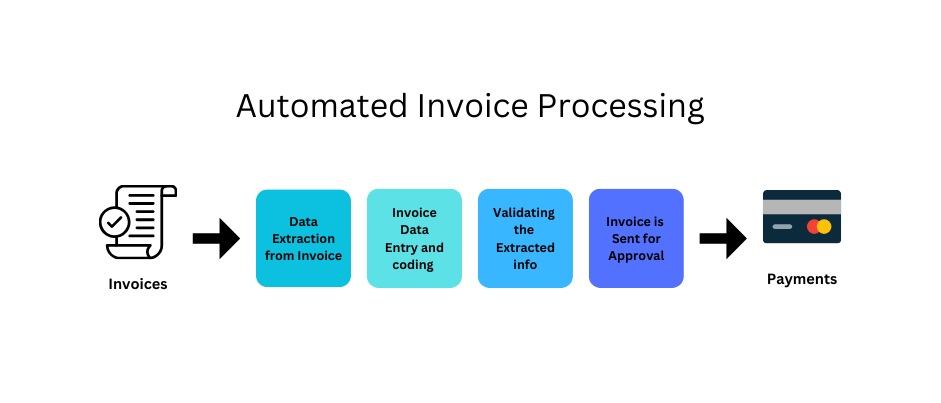

Invoice automation is a sophisticated and transformative solution that leverages technology to streamline and simplify the process of handling invoices within an organization. It involves using software and data capture technology to digitize, capture, and process invoice data, reducing the reliance on manual data entry. With invoice automation, invoices are received electronically, and the system automatically extracts, validates, and routes the data for approval and payment.

This technology accelerates invoice processing, significantly reduces errors, enhances visibility into financial data. And allows organizations to allocate their human resources to more strategic financial tasks. Invoice automation is a powerful tool that modernizes and optimizes the accounts payable process, resulting in increased efficiency and cost savings.

Updating your financial department with automated invoice processing is a strategic move that can drive productivity, enhance accuracy, and save your organization time and money. We explore the benefits of automated invoice processing and provide insights into how your company can transition.

The Challenge of Manual Invoice Processing

Traditional, paper-based invoice processing is a challenging task that often leads to various issues within the financial department. These issues include:

Human Errors: Manual data entry can result in errors, leading to discrepancies in financial records and, consequently, financial losses.

Delayed Processing: Physical invoices take longer to reach the finance department and get processed, resulting in delayed payments and potential late fees.

Inefficiency: Sorting through stacks of paper invoices and manually keying in data is a resource-intensive process, making it an inefficient use of human capital.

Limited Visibility: Tracking the status of invoices and gaining insights into financial data can be challenging with a manual system.

Security Concerns: Paper documents can be lost, damaged, or accessed by unauthorized personnel, posing security risks.

Benefits of Automated Invoice Processing

Automated invoice processing solutions can alleviate these challenges and offer numerous advantages for your financial department:

Improved Accuracy: Automation reduces the risk of human error by digitizing the invoice data. It leads to more precise financial records and fewer discrepancies.

Faster Processing: Automated systems streamline the entire invoice processing cycle, allowing for quicker approvals and payments, which can lead to early payment discounts and improved vendor relationships.

Cost Savings: By reducing the need for manual labor and paper-based processes, automation can significantly reduce operational costs.

Enhanced Efficiency: Employees can shift their focus from tedious data entry to more value-added tasks, such as data analysis and strategic financial planning.

Enhanced Visibility: Automated systems provide real-time visibility into the invoice processing pipeline, making it easier to track the status of invoices and identify potential bottlenecks.

Improved Security: Digital invoices and documents are more secure, as they can be stored in encrypted databases. And have controlled access, reducing the risk of unauthorized access.

Modernize with Automated Invoice Processing

To embark on the journey of modernizing your financial department, follow these steps:

Assess Your Needs: Understand your organization’s unique invoice processing requirements and select a solution that fits your needs, whether cloud-based or on-premises.

Choose the Right Software: Select a reliable invoice processing software or system that offers automation capabilities workflow customization, and integrates with your existing financial software.

Implement Training: Train your financial department staff on the new system to ensure proficiency.

Integration: Integrate the new system with your existing financial and accounting software to streamline data flow and enhance accuracy.

Monitor and Refine: Continuously monitor the system’s performance and gather your team’s feedback to identify improvement areas.

Data Security: Implement robust security measures to protect sensitive financial data, including encryption, access controls, and data backups.

Modernizing your financial department with automated invoice processing is a strategic move. That can significantly boost efficiency and productivity while reducing costs and minimizing the risk of errors. Embracing automation in your financial processes is a step toward a more streamlined. And competitive organization in today’s fast-paced business landscape. By making this transition, you’re modernizing your financial department. And ensuring it remains a valuable and strategic asset within your organization.

How Acumatica Can Help

Acumatica ERP stands out as a versatile and comprehensive solution that has the potential to greatly enhance invoice automation within an organization. Acumatica offers an efficient platform for automating the end-to-end invoice processing workflow through its robust features and seamless integration capabilities. With Acumatica, businesses can digitize invoices, automate data extraction, validate information, and streamline approval processes.

This ERP system provides real-time visibility into financial data, allowing for informed decision-making and proactive cash flow management. Its flexibility and scalability make it suitable for various industries and business sizes. And ensures that invoice automation is efficient and tailored to meet the organization’s needs. By leveraging Acumatica ERP, companies can modernize their financial department, drive productivity, enhance accuracy. And enjoy the substantial benefits of streamlined invoice automation. Contact us for a Customized ERP.

Vijay comes with a vast experience in ERP and enterprise solutions space with about 20 years of experience in various packaged application like Acumatica, SAP, Orion, Salesforce.com, SugarCRM and, SalesLogix.